| | | | | | | | | | | | | | | | | | | | | Named Executive Officer | | 401(k)

Plans ($)(i) | | | Life and

Disability

Insurance ($)(ii) | | | Health Care

Insurance ($)(iii) | | | Other ($)(iv)(v) | | | Total ($) | | Sheldon G. Adelson | | | — | | | $ | 305 | | | $ | 35,476 | | | $ | 3,315,381 | | | $ | 3,351,162 | | Robert G. Goldstein | | $ | 6,890 | | | $ | 11,024 | | | $ | 29,419 | | | $ | 3,541,698 | | | $ | 3,589,031 | | Ira H. Raphaelson | | $ | 6,890 | | | $ | 11,651 | | | $ | 3,769 | | | $ | 191,100 | | | $ | 213,410 | | George M. Markantonis | | | — | | | $ | 3,392 | | | $ | 13,366 | | | $ | 33,612 | | | $ | 50,370 | | Michael A. Quartieri | | | — | | | $ | 1,433 | | | | — | | | $ | 46,442 | | | $ | 47,875 | |

| | (i)LAS VEGAS SANDS 2023 Proxy Statement | | Amounts listed for Mr. Goldstein and Mr. Raphaelson are the matching47

|

— ALL OTHER COMPENSATION FOR 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | NAMED EXECUTIVE OFFICER | | 401(k)

PLAN(i)

($) | | LIFE AND

DISABILITY

INSURANCE(ii)

($) | | HEALTH CARE

INSURANCE(iii)

($) | |

SECURITY(iv)

($) | | OTHER(v)

($) | | TOTAL ($) | | | | | | | | | | Robert G. Goldstein | | | $ | — | | | | $ | 16,868 | | | | $ | 36,143 | | | | $ | 1,061,911 | | | | $ | 1,295,341 | | | | $ | 2,410,263 | | | | | | | | | | | Patrick Dumont | | | $ | — | | | | $ | 2,890 | | | | $ | 5,379 | | | | $ | 1,980,825 | | | | $ | 2,134,586 | | | | $ | 4,123,680 | | | | | | | | | | | Randy Hyzak | | | $ | — | | | | $ | 3,805 | | | | $ | 1,094 | | | | $ | — | | | | $ | 21,793 | | | | $ | 26,692 | | | | | | | | | | | D. Zachary Hudson | | | $ | 5,077 | | | | $ | 2,242 | | | | $ | 4,586 | | | | $ | — | | | | $ | 65,875 | | | | $ | 77,780 | |

| (i) | Matching contributions made under The Venetian Casino Resort LLCthe Las Vegas Sands Corp. 401(k) Retirement Plan, which is a tax-qualified defined contribution plan that is generally available to all of our eligible employees.Team Members. The matching element was reinstated in the third quarter of 2022. |

| (ii) | AmountsThe amounts are imputed as income in connection with our payments in 20152022 of premiums on group term life insurance and short-term disability insurance. A lower amount of group term life insurance is generally available to all salaried employees.Team Members. Short-term disability insurance is also generally available to all salaried employees.Team Members.

|

| (iii) | During 2015, the executive officers2022, Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson participated in a group supplemental medical expense reimbursement plan available only to certain of our senior officers. The supplemental insurance coverage is in excess of the coverage provided by our group medical plan. The amounts in the table represent administration fees and reimbursements of qualified medical expenses related to 2015in 2022 under this plan. The amount in the table for Mr. Markantonis also includes $7,413 in COBRA reimbursements. |

| (iv) | The amount in the table for Mr. Adelson consists of (a)relates to the Company’s cost of $3,053,000 to providefor providing security services to Mr. AdelsonGoldstein and his spouse and to Mr. Dumont and his immediate family (b) $119,181 for accrued dividends received uponbased on the vesting of his restricted stock during 2015, (c) the annual reimbursement of professional fees of $100,000, and (d) the costsrecommendation of an automobile provided to Mr. Adelson of $43,200 for 2015 pursuant to the terms of his employment agreement. independent, third-party security study. |

| (v) | The amount in the table for Mr. Goldstein consists of (a) $2,193,750 for accrued dividends received upon the vesting of his restricted stock during 2015, (b) $1,164,038$1,150,116 related to Mr. Goldstein’s personal use of aircraft based on the aggregate incremental cost to the Company, which is calculated based on the allocable flight-specific costs of the personal flights (including, where applicable, return flights with no passengers) and includes costs such as fuel, catering, crew expenses, navigation fees, ground handling, unscheduled maintenance, ground transportation and air phones, but excludes fixed costs such as depreciation and overhead costs, (c) $166,570(b) $93,203 for the reimbursement of taxes relating to this personal aircraft usage, (c) $46,435 for country club fees and (d) country club dues. The amount in the table$5,587 for Mr. Raphaelson consists of $191,100 for accrued dividends received upon the vesting of his restricted stock during 2015. The amount in the table for Mr. Markantonis consists of $33,612 for moving and relocation costs. The amount in the table for Mr. Quartieri consists of $46,442 for accrued vacation pay.hospitality expenses. |

| | (v) | Our executive officers, as well as certain other employees, are also entitledOf the $2,134,586 in the table for Mr. Dumont, $1,978,951 relates to use workout facilities at the Canyon Ranch Spa at The Venetian Resort Hotel Casino and The Palazzo Resort Hotel Casino in Las Vegas and to receive dry cleaning services. The Company requires these executives to reimburse it in full for theirpersonal use of these facilities and services. On certain occasions, an executive officer’s spouse or other immediate family member has accompaniedCompany-owned aircraft based on the executive officer on business-related flights on aircraft that we own or lease or provide pursuant to time sharing agreements. The Company also permits certain of its named executive officers to use Company personnel for home repairs during business hours on a limited basis. The Company requires that these executives reimburse it in full for these services. There is noaggregate incremental cost to the Company, $145,211 relates to the reimbursement of taxes relating to this personal aircraft usage and $10,424 for any of these benefits.hospitality expenses.

|

(4) | The amount of $21,793 in the table for Mr. Markantonis joinedHyzak relates to the Company in March 2015.personal use of Company-owned aircraft based on the aggregate incremental cost to the Company. |

(5) | The amount of $65,875 in the table for Mr. Quartieri resigned fromHudson relates to the Companypersonal use of Company-owned aircraft based on November 10, 2015.the aggregate incremental cost to the Company. |

| | | | | | | | 48 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

EXECUTIVE COMPENSATION AND OTHER INFORMATION 2015 Grants of Plan-Based Awards

— 2022 GRANTS OF PLAN-BASED AWARDS The following table presents information on potential payment opportunities in respect of 20152022 performance for Messrs. Adelson, Goldstein, Raphaelson, Markantonis and Quartieriour named executive officers. We did not grant any equity awards during calendar year 2022 to our named executive officers under our Executive Cash Incentive PlanAmended and equity awards granted to them during 2015 under ourRestated 2004 Equity Award Plan. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Estimated Future Payouts

Under Non-Equity

Incentive Plan Awards(1) | | | All Other

Stock

Awards:

Number of

Shares

of Stock or

Units

(#) | | | All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#) | | | Exercise or

Base Price

of Option

Awards

($/Sh) | | | Grant Date

Fair Value of

Stock and

Option

Awards(2)

($) | | Name | | Grant

Date | | | Threshold

($) | | | Target

($) | | | Maximum

($) | | | | | | Sheldon G. Adelson | | | 2/4/15 | | | | | | | | | | | | | | | | | | | | 149,712 | | | $ | 55.41 | | | $ | 1,825,000 | | | | | 2/4/15 | | | | | | | | | | | | | | | | 22,167 | | | | | | | | | | | $ | 1,228,273 | | Base bonus | | | | | | | — | | | $ | 2,051,851 | | | $ | 2,051,851 | | | | | | | | | | | | | | | | | | Annual supplemental bonus | | | | | | | — | | | $ | 2,746,666 | | | $ | 5,493,332 | | | | | | | | | | | | | | | | | | Robert G. Goldstein | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual bonus | | | | | | | — | | | $ | 3,250,000 | | | | — | | | | | | | | | | | | | | | | | | Ira H. Raphaelson | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual bonus | | | | | | | — | | | $ | 1,750,000 | | | | — | | | | | | | | | | | | | | | | | | George M. Markantonis | | | 3/30/15 | | | | | | | | | | | | | | | | | | | | 100,000 | | | $ | 55.29 | | | $ | 1,137,000 | | Annual bonus | | | | | | | — | | | $ | 825,000 | | | | — | | | | | | | | | | | | | | | | | | Michael A. Quartieri | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual bonus | | | | | | | — | | | $ | 221,413 | | | | — | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ESTIMATED FUTURE PAYOUTS

UNDER NON-EQUITY

INCENTIVE PLAN AWARDS(1) | | | ALL OTHER

STOCK

AWARDS:

NUMBER OF

SHARES OF

STOCK OR

UNITS (#) | | | ALL OTHER OPTION AWARDS: NUMBER OF SECURITIES UNDERLYING OPTIONS (#) | | | EXERCISE

OR BASE

PRICE OF OPTION AWARDS ($/SH) | | | GRANT DATE FAIR VALUE OF STOCK AND OPTION AWARDS ($) | | | NAME | | GRANT DATE | | | THRESHOLD ($) | | | TARGET ($) | | | MAXIMUM ($) | | | | | | | | | | | | Robert G. Goldstein | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual Bonus | | | — | | | $ | 5,100,000 | | | $ | 6,000,000 | | | $ | 6,900,000 | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | RSU Award | | | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | Stock Option | | | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | Patrick Dumont | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual Bonus | | | — | | | $ | 4,250,000 | | | $ | 5,000,000 | | | $ | 5,750,000 | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | RSU Award | | | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | Stock Option | | | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | Randy Hyzak | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual Bonus | | | — | | | $ | 1,275,000 | | | $ | 1,500,000 | | | $ | 1,725,000 | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | RSU Award | | | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | Stock Option | | | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | D. Zachary Hudson | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual Bonus | | | — | | | $ | 1,168,750 | | | $ | 1,375,000 | | | $ | 1,581,250 | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | RSU Award | | | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | | | | | | | | | | | | Stock Option | | | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | |

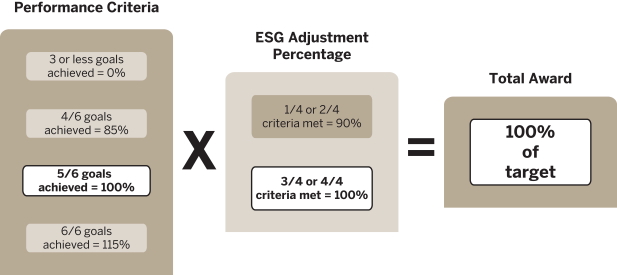

| (1) | The amounts shown in these columns for Mr. Adelson represent athe range of potential incentive payment opportunities for 20152022 based on achieving certain specified annualized EBITDA assumptions under his employment agreement and our Executive Cash Incentive Plan. Threshold amounts are not included inperformance criteria established by the table because, in accordance with his employment agreement,Compensation Committee. For 2022, Mr. Adelson is not entitled to receive a base bonus payment unless the Company achieves the 2015 base bonus EBITDA performance target. Mr. Adelson is not entitled to receive an annual supplemental bonus payment unless the Company achieves at least 80% of the 2015 annual supplemental bonus EBITDA performance target. Under their employment agreements or other arrangements with the Company, Messrs. Goldstein Raphaelson and Markantonis are, and Mr. Quartieri was, eligible to receive discretionary bonuses based solely on the Company’s achievement of EBITDA-based performance objectives. For 2015, Messrs. Goldstein, Raphaelson, Markantonis and QuartieriDumont were eligible to receive discretionary bonuses of 100%, 100%, 75% and 50%, respectively,200% of their annual base salaries (pro-rated for the periods of employment for Mr. Markantonis and Mr. Quartieri), provided the threshold performance targets,Hyzak and Mr. Hudson were eligible to receive bonuses of 125% of their annual base salaries, in each to the extent the performance criteria set by the Compensation Committee were met. For Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson, the bonuses are payable at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The actual bonus payout is determined by the Compensation Committee. See the discussion below under “— Employment Agreements,” as well as above under “Compensation Discussion and Analysis—Elements of“2022 Executive Officer Compensation and Why We Chose to Pay Each Element—Short-term Incentives”Performance Criteria” for more information regarding bonus incentive awards. |

(2) | | | | | | | |

| | Calculated based on the aggregate grant date fair value computed in accordance with accounting standards regarding share-based payments. For a discussion of the relevant assumptions used in the calculation of these amounts, see Note 14 to the consolidated financial statements for the year ended December 31, 2015 included in the Company’s 2015 Annual Report on Form 10-K.LAS VEGAS SANDS 2023 Proxy Statement

| | 49 |

Employment Agreements

The executive employment agreements and other arrangements provide for the payment of base salary, cash incentive bonuses and equity incentive awards as described below.

Mr. Adelson. Mr. Adelson’s employment agreement provides for an annual base salary. He also is eligible for target base bonus and annual supplemental bonus payments and annual awards of options to purchase shares of Common Stock and shares of restricted stock as described under “Compensation Discussion and Analysis —Elements of Executive Officer Compensation and Why We Chose to Pay Each Element.”

Mr. Goldstein. Mr. Goldstein’s employment agreement provides for an annual base salary and a grant of 2,250,000 stock options. Mr. Goldstein also is eligible to receive a discretionary annual bonus of 100% of his base salary, or $3,250,000, based on performance criteria approved by the Compensation Committee in accordance with the Company’s Management Incentive Program. On December 9, 2014, Mr. Goldstein received the grant of stock options, of which 250,000 vested on December 9, 2015, 350,000 vest on December 9, 2016, 400,000 vest on December 9, 2017, 250,000 vest on December 9, 2018, and 1,000,000 vest on December 31, 2019.

Mr. Raphaelson. Mr. Raphaelson’s 2011 Employment Agreement provided and his 2016 Employment Agreement provides for an annual base salary. Under his 2011 Employment Agreement, Mr. Raphaelson was eligible to receive an annual cash bonus for 2015 of a maximum of 100% of his annual base salary, or $1,500,000, based on the achievement of Company and personal performance objectives and subject to the Company’s Management Incentive Program. In December 2013, Mr. Raphaelson and the Company agreed that his annual bonuses for the remainder of the term of his 2011 Employment Agreement would be based solely on the Company’s achievement of EBITDA-based performance targets established by the Compensation Committee. On November 1, 2011, Mr. Raphaelson received a grant of 42,000 restricted stock units pursuant to his 2011 Employment Agreement. The restricted stock units vested in equal amounts on November 1, 2014 and November 1, 2015. Under his 2016 Employment Agreement, Mr. Raphaelson is eligible for an annual bonus with a maximum of 100% of his base salary, or $1,750,000, subject to the achievement of personal performance criteria approved by the Chief Executive Officer and established by the Compensation Committee. In addition, he received a grant of 150,000 stock options, which will vest in four equal installments of 37,500 on December 31, 2016, 2017, 2018 and 2019.

Mr. Markantonis. Mr. Markantonis’s employment agreement provides for an annual base salary and a grant of 100,000 stock options. Under his employment agreement, Mr. Markantonis also is eligible to receive a discretionary bonus of 75% of his base salary, or $825,000, based on the achievement of Company and personal performance goals and subject to the Company’s Management Incentive Program. On March 30, 2015, Mr. Markantonis received the grant of stock options, which will vest in four equal installments of 25,000 on March 17, 2017, 2018, 2019 and 2020.

Mr. Quartieri. Mr. Quartieri did not have an employment agreement with us.

For additional information about the employment agreements, see “Compensation Discussion and Analysis —Elements of Executive Officer Compensation and Why We Choose to Pay Each Element — Employment Agreements” and “— Potential Payments Upon Termination or Change in Control.”

Outstanding Equity Awards at 2015 Fiscal Year-EndOUTSTANDING EQUITY AWARDS AT 2022 FISCAL YEAR-END

The following table sets forth information concerning Las Vegas Sands Corp.our stock options and shares of restricted stock and restricted stock units held by Messrs. Adelson, Goldstein, Raphaelson, Markantonis and Quartieri atour named executive officers as of December 31, 2015.2022: | | | | | | | | | | | | | | | | | | | | | | | | | | | | Option Awards | | | Stock Awards | | Name | | Number of

Securities

Underlying

Unexercised

Options

(#) Exercisable | | | Number of

Securities

Underlying

Unexercised

Options

(#) Unexercisable | | | Option

Exercise

Price

($) | | | Option

Expiration

Date | | | Number of

Shares or

Units of Stock

That Have

Not Vested

(#) | | | Market Value

of Shares or

Units of Stock

That Have

Not Vested(9)

($) | | Sheldon G. Adelson | | | — | | | | 12,856 | (1) | | $ | 49.80 | | | | 2/8/2022 | | | | 44,287 | (8) | | $ | 1,941,542 | | | | | — | | | | 28,779 | (2) | | $ | 51.08 | | | | 1/28/2023 | | | | | | | | | | | | | 13,793 | | | | 41,376 | (3) | | $ | 75.26 | | | | 1/27/2024 | | | | | | | | | | | | | — | | | | 149,712 | (4) | | $ | 55.41 | | | | 2/3/2025 | | | | | | | | | | Robert G. Goldstein | | | 30,988 | | | | — | | | $ | 83.86 | | | | 3/29/2017 | | | | | | | | | | | | | 39,155 | | | | — | | | $ | 70.84 | | | | 3/28/2018 | | | | | | | | | | | | | 250,000 | | | | 2,000,000 | (5) | | $ | 56.11 | | | | 12/8/2024 | | | | | | | | | | Ira H. Raphaelson | | | — | | | | — | | | | — | | | | — | | | | | | | | | | George M. Markantonis | | | — | | | | 100,000 | (6) | | $ | 55.29 | | | | 3/16/2025 | | | | | | | | | | Michael A. Quartieri | | | 10,000 | (7) | | | — | | | $ | 79.60 | | | | 11/9/2016 | | | | | | | | | | | | | 15,000 | (7) | | | — | | | $ | 66.85 | | | | 4/22/2018 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | OPTION AWARDS | | | STOCK AWARDS | | | | | | | | | | | | NAME | | NUMBER OF SECURITIES UNDERLYING

UNEXERCISED OPTIONS (#) EXERCISABLE | | | NUMBER OF SECURITIES UNDERLYING UNEXERCISED OPTIONS (#) UNEXERCISABLE | | | EQUITY INCENTIVE

PLAN AWARDS:

NUMBER OF

SECURITIES

UNDERLYING

UNEARNED

OPTIONS (#) | | | OPTION EXERCISE PRICE ($) | | | OPTION EXPIRATION DATE | | | NUMBER OF SHARES OR UNITS OF STOCK THAT HAVE NOT VESTED (#) | | | MARKET

VALUE OF

SHARES OR UNITS OF

STOCK THAT HAVE NOT VESTED(6) ($) | | | | | | | | | | | | Robert G. Goldstein | | | 2,250,000 | | | | — | | | | — | | | $ | 56.11 | | | | 12/8/2024 | | | | — | | | $ | — | | | | | | | | | | | | | | | 1,000,000 | | | | 1,500,000 | (1) | | | — | | | $ | 50.33 | | | | 11/19/2028 | | | | — | | | $ | — | | | | | | | | | | | | | | | 666,000 | | | | 1,334,000 | (2) | | | | | | $ | 34.28 | | | | 12/2/2031 | | | | 100,500 | (7) | | $ | 4,831,035 | | | | | | | | | | | | Patrick Dumont | | | 425,000 | | | | — | | | | — | | | $ | 52.53 | | | | 3/28/2026 | | | | — | | | $ | — | | | | | | | | | | | | | | | 499,500 | | | | 1,000,500 | (3) | | | | | | $ | 34.28 | | | | 12/2/2031 | | | | 56,057 | (8) | | $ | 2,694,660 | | | | | | | | | | | | Randy Hyzak | | | 21,910 | | | | — | | | | — | | | $ | 58.81 | | | | 10/3/2026 | | | | — | | | $ | — | | | | | | | | | | | | | | | 21,358 | | | | — | | | | — | | | $ | 63.89 | | | | 6/29/2027 | | | | — | | | $ | — | | | | | | | | | | | | | | | 17,424 | | | | — | | | | — | | | $ | 75.18 | | | | 2/1/2028 | | | | — | | | $ | — | | | | | | | | | | | | | | | 35,635 | | | | — | | | | — | | | $ | 59.89 | | | | 1/31/2029 | | | | — | | | $ | — | | | | | | | | | | | | | | | 26,614 | | | | 13,306 | (4) | | | — | | | $ | 65.31 | | | | 1/30/2030 | | | | — | | | $ | — | | | | | | | | | | | | | | | 166,500 | | | | 333,500 | (5) | | | | | | $ | 34.28 | | | | 12/2/2031 | | | | 16,817 | (9) | | $ | 808,393 | | | | | | | | | | | | D. Zachary Hudson | | | 150,000 | | | | — | | | | — | | | $ | 57.76 | | | | 9/29/2029 | | | | — | | | $ | — | | | | | | | | | | | | | | | 166,500 | | | | 333,500 | (5) | | | — | | | $ | 34.28 | | | | 12/2/2031 | | | | 15,415 | (10) | | $ | 740,999 | |

| (1) | The remaining unvested portion of this stock option grant vests as follows: 500,000 options vested on January 1, 2023, 500,000 options vest on January 1, 2024 and 500,000 options vest on December 31, 2024. |

| (2) | The remaining unvested portion of this stock option grant vests as follows: 666,000 options vest on December 3, 2023 and 668,000 options vest on December 3, 2024. |

| (3) | The remaining unvested portion of this stock option grant vests as follows: 499,500 options vest on December 3, 2023 and 501,000 options vest on December 3, 2024. |

| (4) | The remaining unvested portion of this stock option grant vested on January 1, 2016.31, 2023. |

(2)(5) | The remaining unvested portion of this stock option grant vests in two equal installments on January 1, 2016 (which has vested) and January 1, 2017. |

(3) | The remaining unvested portion of this stock option grant vests in three equal installments on January 1, 2016 (which has vested), January 1, 2017 and January 1, 2018.

|

(4) | The stock option grant vests in four equal installments on January 1, 2016 (which has vested), January 1, 2017, January 1, 2018 and January 1, 2019.

|

(5) | This stock option grant vests as follows: 350,000166,500 options vest on December 9, 2016, 400,0003, 2023 and 167,000 options vest on December 9, 2017, 250,000 options vest on December 9, 2018 and 1,000,000 options vest on December 31, 2019.3, 2024.

|

| (6) | The stock option grant vests in four equal installments on March 17, 2017, March 17, 2018, March 17, 2019 and March 17, 2020.

|

(7) | These options were subsequently forfeited on February 8, 2016 in connection with Mr. Quartieri’s resignation from the Company.

|

(8) | The remaining unvested portion of restricted stock awards as to 5,954 shares vested on January 1, 2016, the remaining unvested portion of restricted stock awards as to 16,166 shares vests in two equal installments on January 1, 2016 (which has vested) and January 1, 2017, with the remaining unvested portion of restricted stock awards as to 22,167 shares vesting in three equal installments on January 1, 2016 (which has vested), January 1, 2017 and January 1, 2018.

|

(9) | Market value is determined based on the closing price of our Common Stock of $43.84$48.07 on December 31, 201530, 2022, as reported on the NYSE and equals the closing price multiplied by the number of shares underlying the grants for Mr. Adelson.grants. |

| (7) | The remaining unvested restricted stock units vests as follows: 49,500 restricted stock units vest on April 26, 2023 and 51,000 restricted stock units vest on April 26, 2024. |

| (8) | The remaining unvested restricted stock units vests as follows: 27,610 restricted stock units vest on April 26, 2023 and 28,447 restricted stock units vest on April 26, 2024. |

| (9) | The remaining unvested restricted stock units vests as follows: 8,283 restricted stock units vest on April 26, 2023 and 8,534 restricted stock units vest on April 26, 2024. |

| (10) | The remaining unvested restricted stock units vests as follows: 7,593 restricted stock units vest on April 26, 2023 and 7,822 restricted stock units vest on April 26, 2024. |

| | | | | | | | 50 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

EXECUTIVE COMPENSATION AND OTHER INFORMATION Option Exercises and Stock Vested in 2015

— OPTION EXERCISES AND STOCK VESTED IN 2022 The following table sets forth information concerning the exercise of stock options and the vesting of restricted stock awards by theour named executive officers during 2015.2022: | | | | | | | | | | | | | | | | | | | | Option Awards | | | Stock Awards | | Name | | Number of Shares

Acquired on

Exercise

(#) | | | Value Realized on

Exercise(1)

($) | | | Number of Shares

Acquired on Vesting

(#) | | | Value Realized

on Vesting(2)

($) | | Sheldon G. Adelson | | | 39,883 | | | $ | 487,945 | | | | 25,614 | | | $ | 1,489,710 | | Robert G. Goldstein | | | 353,254 | | | $ | 16,875,597 | | | | 225,000 | | | $ | 9,864,000 | | Ira H. Raphaelson | | | — | | | $ | — | | | | 21,000 | | | $ | 1,039,710 | | George M. Markantonis | | | — | | | $ | — | | | | — | | | $ | — | | Michael A. Quartieri | | | 36,750 | | | $ | 978,019 | | | | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | OPTION AWARDS | | STOCK AWARDS | | | | | | | | NAME | | NUMBER OF SHARES ACQUIRED ON EXERCISE (#) | | VALUE REALIZED ON EXERCISE ($) | | NUMBER OF SHARES VESTED (#) | | VALUE REALIZED

ON VESTING(1)

($) | | | | | | | | Robert G. Goldstein | | | | — | | | | $ | — | | | | | 49,500 | | | | $ | 1,720,125 | | | | | | | | | Patrick Dumont | | | | — | | | | $ | — | | | | | 27,611 | | | | $ | 959,482 | | | | | | | | | Randy Hyzak | | | | — | | | | $ | — | | | | | 8,283 | | | | $ | 287,834 | | | | | | | | | D. Zachary Hudson | | | | — | | | | $ | — | | | | | 7,593 | | | | $ | 263,857 | |

| (1) | The value realized on exercise is the difference between the market price of our Common Stock as reported on the NYSE at the time of exercise minus the closing price of our Common Stock at the time of grant times the number of exercised stock options.

|

(2) | Market value on each vesting date is determined based on the closing price of our Common Stock as reported on the NYSE on the applicable vesting date (or the last trading date before the vesting date if the vesting date falls on a non-trading date) and equals the closing price multiplied by the number of vested shares. |

— POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL Potential Payments Upon Termination or Change in Control

Employment Agreements The employment agreements for Messrs. Adelson,Mr. Goldstein, RaphaelsonMr. Dumont, Mr. Hyzak and Markantonis in effect on December 31, 2015Mr. Hudson provide or provided for payments and the continuation of benefits upon certain terminations of employment and/or if there is a change in control offrom the Company. All payments under the executive employment agreements for Messrs. Adelson,Mr. Goldstein, RaphaelsonMr. Dumont, Mr. Hyzak and MarkantonisMr. Hudson in connection with a termination of employment are subject to the applicable named executive officer’s agreement to release the Company from all claims relating to his employment and the termination of his employment. These named executive officers also are subject to covenants restricting their ability to compete with the Company or to hire Company employeesTeam Members for a specified period following termination of employment. Change in Control Arrangements The following summaries are qualifiedemployment agreements for Mr. Goldstein, Mr. Dumont, Mr. Hyzak, and Mr. Hudson provide severance benefits in all respects by the termscontext of a “change in control” of the applicable employment agreements and applicable law. Mr. Adelson

In the event of a termination of Mr. Adelson’s employment for cause (as defined below) or his voluntary termination (other than for good reason (as defined below)), all of his salary and benefits will immediately cease (subject to any requirements of law).

In the event of a termination of Mr. Adelson’s employment by us without cause or a voluntary termination by Mr. Adelson for good reason (as defined below) other than during the two-year period following a change in control (asCompany, which is defined in the Company’sour Amended and Restated 2004 Equity Award Plan and below), we will be obligatedis deemed to pay or provide Mr. Adelson with:

all accrued and unpaid base salary and bonus(es) through the date of termination;

his salary and base bonus, if applicable, for the remainder of the term of his employment agreement or, if he becomes employed elsewhere, the difference, if any, between 50% of the salary and bonus compensation earned in such other employment and the salary and base bonus, if applicable, payable under his employment agreement with us;

a pro rata annual supplemental bonus for the year of termination of employment at the time the bonus would normally be paid;

full vesting of all unvested options and restricted stock outstanding on the date of termination of employment; and

continued health and welfare benefits for the remainder of the term of the employment agreement (or, if earlier, until he receives health and welfare coverage from a subsequent employer).

In the event of a termination of Mr. Adelson’s employment by us without cause or a termination by Mr. Adelson for good reason within the two-year period following a change in control or Mr. Adelson’s voluntary termination at any time during the one-year period following a change in control, we will be obligated to pay or provide Mr. Adelson with:

all accrued and unpaid base salary and bonus(es) through the date of termination;

a lump sum payment of two times his salary plus, if applicable, his target base bonus and target annual supplemental bonus for the year of termination;

full vesting of all unvested options and restricted stock awards outstanding on the date of termination of employment;

a pro rata target base bonus and target annual supplemental bonus for the year of termination of employment; and

continued health and welfare benefits for two years following termination (or, if earlier, until Mr. Adelson receives health and welfare coverage from a subsequent employer).

If the change in control, however, does not satisfy the definition of a change in the ownership or effective control of a corporation or a change in the ownership of a substantial portion of the assets of a corporation, pursuant to Section 409A of the Code, then the payment of two times salary plus base bonus will be paid ratably for the remainder of the term of the employment agreement and the pro rata annual bonus for the year of termination will be paid at the same time annual bonuses would normally be paid to other executive officers of the Company.

In the case of a termination of Mr. Adelson’s employment due to his death or disability (as defined in his employment agreement), Mr. Adelson (or his estate) will be entitled to receive:

all accrued and unpaid base salary and bonus(es) through the date of termination;

continued payments of salary and, if applicable, base bonus, less any applicable short-term disability insurance payments, for a period of 12 months following the date of termination of employment;

accelerated vesting of options and restricted stock awards such that all such options and awards that would have vested during the 12-month period following the date of termination will become vested as of the date of termination of employment; and

a pro rata annual supplemental bonus payable at the time the bonus would normally be paid.

In the event of a termination of Mr. Adelson’s employment due to his retirement or a non-renewal termination, we will be obligated to pay or provide Mr. Adelson with:

all accrued and unpaid base salary and bonus(es) through the date of termination;

in the case of his retirement, a pro rata annual bonus for the year of termination of employment at the time the bonus would normally be paid; and

continued vesting of all equity awards (including incentive awards granted under his employment agreement) in accordance with their terms so that all such awards continue to vest at the same rate as if Mr. Adelson had remained employed by the Company.

If Mr. Adelson terminates his employment on or after the last day of a fiscal year but before the actual grant date of the restricted stock award for that fiscal year, he will be granted a fully vested award for that fiscal year on the date the award would have otherwise been made (and subject to the applicable performance target being achieved) equal to the number of shares he would have been awarded multiplied by the following applicable percentage:

0% if the termination was for cause or a voluntary termination (other than for good reason or retirement);

| • | | 33 1/3% if the termination was due to death or disability; and

|

100% if the termination is by us without cause or by the executive for good reason or due to retirement.

Definitions. The terms “cause,” “good reason” and “change in control” are defined in Mr. Adelson’s employment agreement as follows:

Mr. Adelson may be terminated by the Company for “cause” if:

he is convicted of a felony, misappropriates any material funds or material property of the Company, its subsidiaries or affiliates, commits fraud or embezzlement with respect to the Company, its subsidiaries or affiliates or commits any material act of dishonesty relating to his employment by the Company resulting in direct or indirect personal gain or enrichment at the expense of the Company, its subsidiaries or affiliates;

he uses alcohol or drugs that render him materially unable to perform the functions of his job or carry out his duties to the Company and fails to correct his behavior following written notice;

he materially breaches his employment agreement and fails to correct the breach following written notice;

he commits any act or acts of serious and willful misconduct (including disclosure of confidential information) that is likely to cause a material adverse effect on the business of the Company, its subsidiaries or affiliates; or

his gaming license is revoked or suspended by Nevada gaming authorities and he fails to correct the situation following written notice; provided, that in the event that the revocation or suspension occurs without there having been any fault on his part, the termination will be treated in the same manner as a termination due to disability instead of for “cause.”

Mr. Adelson may terminate his employment with the Company for “good reason” if:

the Company fails to maintain him as Chairman of the Board of Directors and Chief Executive Officer, unless the Board determines that these positions must be held by someone other than Mr. Adelson due to applicable statutory, regulatory or stock exchange requirements, or if this practice is common among companies of similar size in similar industries to us, and the Board determines that this practice constitutes best practices of corporate governance;

the Company reduces his base salary;

subject to specified exceptions, the Company reduces his target base bonus, target annual bonus or target incentive award opportunity;

there is a material change in his duties and responsibilities that would cause his position to have less dignity, importance or scope than intended at the time of the agreement, except for changes resulting from a transaction in which the Company becomes a subsidiary of another company, so long as his duties and responsibilities are not materially changed as they relate solely to the Company; or

the Company materially breaches the employment agreement.

A “change in control” occursoccur upon:

| • | | the acquisition by any individual, entity or group of beneficial ownership of 50% or more (on a fully diluted basis) of either the then outstanding shares of the Company’sour Common Stock or the combined voting power of theour then outstanding voting securities of the Company entitled to vote generally in the election of directors;provided,,however,, that the following acquisitions shall not constitute a change in control: (I)(i) any acquisition by the Company or any affiliate (as defined), (II)(ii) any acquisition by any employeeTeam Member benefit plan sponsored or maintained by the Company or any affiliate, (III)(iii) any acquisition by Mr. AdelsonAdelson’s estate or any related party (as defined)defined in our Amended and Restated 2004 Equity Award Plan) or any group of which Mr. AdelsonAdelson’s estate or a related party is a member, (IV)(iv) certain reorganizations, recapitalizations, mergers, consolidations, statutory share exchanges or similar forms of corporate transaction that do not result in a change of ultimate control of more than 50% of the total voting power of the resulting entity or the change in a majority of the board of directors,Board, or (V)(v) in respect of an executive officer, any acquisition by the executive officer or any group of persons including the executive officer (or any entity controlled by the executive officer or any group of persons including the executive officer); |

the incumbent members of the board of directors on the date that the agreement was approved by the incumbent directors or directors elected by stockholder vote (other than directors elected as the result of an actual or threatened election contest) cease for any reason to constitute at least a majority of the board;

the Company’s dissolution or liquidation;

the sale, transfer or other disposition of all or substantially all of the Company’s business or assets other than any sale, transfer or disposition to Mr. Adelson or one of his related parties; or

the consummation of certain reorganizations, recapitalizations, mergers, consolidations, statutory share exchanges or similar forms of corporate transaction unless, immediately following any such business combination, there is no change of ultimate control of more than 50% of the total voting power of the resulting entity or change in a majority of the board of directors.

Mr. Goldstein

Mr. Goldstein’s employment agreement provides, that, in the event that his employment is terminated by the Company for cause (as defined in his employment agreement and below), then Mr. Goldstein would be entitled to receive:

base salary through the date of termination of employment; and

| • | | the “Goldstein Standard Benefits” consisting of:incumbent members of the Board on the date that the agreement was approved by the incumbent directors or directors elected by stockholder vote (other than directors elected as the result of an actual or threatened election contest) cease for any reason to constitute at least a majority of the Board; |

| • | | the Company’s dissolution or liquidation; |

| • | | the sale, transfer or other disposition of all or substantially all of the Company’s business or assets other than any sale, transfer or disposition to Mr. Adelson’s estate or one of his related parties; or |

| • | | the consummation of certain reorganizations, recapitalizations, mergers, consolidations, statutory share exchanges or similar forms of corporate transaction unless, immediately following any such business combination, there is no change of ultimate control of more than 50% of the total voting power of the resulting entity or change in a majority of the Board. |

| | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 51 |

reimbursement for expenses incurred, but not paid prior to such terminationExecutive Officers’ Benefits upon Termination or Change in Control

In March 2021, we entered into new or amended employment agreements with each of employment, subjectMr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson. Changes to the receiptexecutive officers, and their role and title (except for Mr. Hudson) reflect the implementation of supporting informationthe succession plan accomplished in early 2021. The new or amended employment agreements were implemented to reflect: (i) new roles and responsibilities for certain executives and (ii) stockholder feedback regarding certain components of our previous employment agreements, including lower base salary for Mr. Goldstein and increased percentage of compensation at-risk for all executive officers. The following summaries are qualified in all respects by the Company; and such other compensation and benefits as may be provided in applicable plans and programsterms of the applicable employment agreements entered into in March 2021 and applicable law.

Mr. Goldstein The Company accordingis obligated to the terms and conditions of such plans and programs. In the event that Mr. Goldstein’s employment is terminated by the Company without cause (and other than due to his deathpay or disability), orprovide Mr. Goldstein terminates(or his employment for good reason (as defined in his employment agreement and below), then,estate) the following under the various termination scenarios pursuant to his amended employment agreement, Mr. Goldstein would be entitled to receive, in addition to the Goldstein Standard Benefits:agreement:

| | | | | | REASON FOR TERMINATION | | MR. GOLDSTEIN IS ENTITLED TO: | | | | Company Terminates for Cause | | “Goldstein Accrued Benefits” consisting of: • base salary through the date of termination of employment • all previously earned bonuses through the date of termination of employment • reimbursement for expenses incurred, but not paid, prior to such termination of employment, subject to the receipt of supporting information by the Company • such other compensation and benefits as may be provided in applicable plans and programs of the Company, according to the terms and conditions of such plans and programs | | | Company Terminates Without Cause or Executive Officer Terminates for Good Reason | | • Goldstein Accrued Benefits • a lump sum payment in the amount of two times the sum of his base salary plus his target bonus • any unpaid bonus for the calendar year preceding the date of termination of employment • pro-rata target bonus for the year of termination • accelerated vesting of equity, except for the one-time performance-based stock options, which, in accordance with the applicable award agreement, will remain outstanding and will continue to vest as set out in the applicable award agreement | | | Company Terminates Without Cause or Executive Officer Terminates for Good Reason within 24 months following a Change in Control | | • Goldstein Accrued Benefits • accelerated vesting of equity, except for the one-time performance-based stock options, which, in accordance with the applicable award agreement, will continue to vest as set out in the applicable award agreement • a lump sum payment in the amount of three times the sum of his base salary plus target bonus • any unpaid bonus for the calendar year preceding the date of termination of employment; • pro-rata target bonus for the year of termination • continued participation in the health and welfare benefit plans of the Company and employer contributions to non-qualified retirement plans and deferred compensation plans, if any, for two years following the date of termination |

| | | | | | | | 52 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

continuation of his base salary for 12 months following termination of employment (or, if shorter, the remainder of the initial term of his employment agreement).

Under Mr. Goldstein’s employment agreement, he is permitted to terminate his employment with the Company upon 30 days’ written notice following a change in control (as defined in his employment agreement and the description of Mr. Adelson’s employment agreement above); provided that his termination of employment may not be effective until 12 months following the change in control. Under those circumstances, he would be entitled to receive:EXECUTIVE COMPENSATION AND OTHER INFORMATION

all accrued and unpaid base salary and previously earned bonus(es) through the date of termination;

| | | | | | REASON FOR TERMINATION | | MR. GOLDSTEIN IS ENTITLED TO: | | | Death or Disability | | • Goldstein Accrued Benefits • a lump sum payment in the amount of two times his base salary • any unpaid bonus for the calendar year preceding the date of termination of employment • accelerated vesting of equity, except for the one-time performance-based stock options, which, in accordance with the applicable award agreement, will expire to the extent unvested on the date of termination of employment due to death or disability | | | Termination After the Employment Term Expires | | • in the event Mr. Goldstein’s employment terminates after the expiration of his employment term (March 1, 2026) for any reason, all equity awards previously granted pursuant to his employment agreement or otherwise will immediately vest |

a lump sum payment of two (2) times his base salary;

accelerated vesting of the grant of 375,000 shares of restricted stock granted to Mr. Goldstein on March 8, 2012 under his prior employment agreement (which grant vested in full on December 31, 2015) and the 2,250,000 stock options granted to Mr. Goldstein on December 9, 2014 under his employment agreement; and

continued participation in the health and welfare benefit plans of the Company and employer contributions to non-qualified retirement plans and deferred compensation plans, if any,The reasons for two years following the date of termination provided that the Company’s obligation to provide these benefits shall cease under certain circumstances.

Under his employment agreement, in the event that Mr. Goldstein’s employment with the Company is terminated due to his death or disability (as defined in his employment agreement and below), then Mr. Goldstein or his estate, as the case may be, would be entitled to receive, in addition to the Goldstein Standard Benefits:

continuation of his base salary for 12 months following termination of employment (or, if shorter, the remainder of the initial term of his employment agreement), less (1) any short-term disability insurance proceeds he receives during such period in the event termination of his employment is due to his disability and (2) any life insurance proceeds Mr. Goldstein’s estate receives from company-paid life insurance policies in the event of his death;

accelerated vesting of the grant of 375,000 shares of restricted stock granted to Mr. Goldstein on March 8, 2012 under his prior employment agreement for the portion of the restricted stock award that would have vested during the 12-month period following the date of termination (which grant vested in full on December 31, 2015); and

accelerated vesting of the grant of 2,250,000 stock options granted to Mr. Goldstein on December 9, 2014 under his employment agreement in the event of a termination of his employment in the 2019 calendar year for that portion of the stock option grant that would have vested during the 2019 calendar year.

Definitions. The terms “cause,” “disability” and “good reason” are defined in Mr. Goldstein’s employment agreement as follows:

Mr. Goldstein may be terminated by the Company for “cause” if:

he is convicted of a felony or misappropriates any material funds or material property of the Company, its subsidiaries or affiliates;

he commits fraud or embezzlement with respect to the Company, its subsidiaries or affiliates;

he commits any material act of dishonesty relating to his employment by the Company resulting in direct or indirect personal gain or enrichment at the expense of the Company, its subsidiaries or affiliates;

he uses alcohol or drugs that render him materially unable to perform the functions of his job or to carry out his duties to the Company and he fails to correct the situation following written notice;

he commits a material breach of his employment agreement and he fails to correct the situation following written notice;

he commits any act or acts of serious and willful misconduct (including disclosure of confidential information) that is likely to cause a material adverse effect on the business of the Company, its subsidiaries or affiliates; or

his gaming license is withdrawn with prejudice, denied, revoked or suspended by any of the gaming authorities with jurisdiction over the Company or its affiliates and he fails to correct the situation following written notice.

The term “disability” is defined in Mr. Goldstein’s employment agreement to mean that Mr. Goldstein shall, in the opinion of an independent physician selected by agreement between the Board of Directors and Mr. Goldstein, become so physically or mentally incapacitated that he is unable to perform the duties of his employment for an aggregate of 180 days in any 365-day consecutive period or for a continuous period of six consecutive months.

The term “good reason” is defined in Mr. Goldstein’s employment agreement to mean: the occurrence of any of the following without Mr. Goldstein’s consent:

the Company’s removal of Mr. Goldstein from the position of President and Chief Operating Officer of the Company; or

any other material adverse change in Mr. Goldstein’s status, position, duties or responsibilities (which shall include any adverse change in the reporting relationships described in his employment agreement) which is not cured within thirty (30) days after written notice thereof is delivered by Mr. Goldstein to the Company.

Mr. Raphaelson

Mr. Raphaelson’s 2011 Employment Agreement (which was effective until November 1, 2015) provided that, in the event that his employment was terminated by the Company for cause (as defined in his 2011 Employment Agreement and below), then Mr. Raphaelson would be entitled to receive:

base salary through the date of termination of employment; and

| • | | the “Raphaelson 2011 Standard Benefits” consisting of:

|

reimbursement for expenses incurred, but not paid prior to such termination of employment, subject to the receipt of supporting information by the Company; and

such other compensation and benefits as may be provided in applicable plans and programs of the Company, according to the terms and conditions of such plans and programs.

In the event that Mr. Raphaelson’s employment was terminated by the Company without cause or by Mr. Raphaelson for good reason (as defined in his 2011 Employment Agreement and below), then, pursuant to his 2011 Employment Agreement, Mr. Raphaelson would be entitled to receive:

continuation of his base salary for (a) 12 months if his employment was terminated by the Company without cause or by Mr. Raphaelson for good reason other than due to a change of control, subject to offset if Mr. Raphaelson obtained replacement employment, and (b) three months if Mr. Raphaelson terminated his employment for good reason due to a change of control after November 1, 2014, with no offset if Mr. Raphaelson obtained replacement employment;

the pro-rated portion of the annual bonus Mr. Raphaelson would have earned during the year his 2011 Employment Agreement was terminated;

reimbursement for reasonable expenses incurred, but not paid prior to such termination of employment, subject to the receipt of supporting information by the Company;

continued vesting of all equity awards granted during the term of Mr. Raphaelson’s employment, other than his sign-on equity award, for 12 months following his termination date; and

continued participation in the health and welfare benefit plans of the Company for Mr. Raphaelson and his spouse and dependents, if any, for (a) 12 months if Mr. Raphaelson’s employment was terminated by the Company without cause and (b) three months if Mr. Raphaelson terminated his employment for good reason.

In the event that Mr. Raphaelson’s employment was terminated upon the expiration of the term of his 2011 Employment Agreement without renewal or superseding agreement between the parties, then Mr. Raphaelson would be entitled to receive, in addition to the Raphaelson 2011 Standard Benefits:

base salary through the date of termination of employment;

a pro-rated cash (but not equity) bonus for 2015 when such bonuses are awarded; and

continued vesting of equity awards granted during the term of Mr. Raphaelson’s employment, other than his sign-on equity award, for 12 months following his termination date.

In the event that Mr. Raphaelson’s employment was terminated due to his death or disability (as defined in his 2011 Employment Agreement and below), then, pursuant to his 2011 Employment Agreement, Mr. Raphaelson or his estate, as the case may be, would be entitled to receive:

continuation of his base salary for a 12-month period following the termination of his employment;

reimbursement for reasonable expenses incurred but not paid prior to such termination of employment, subject to the receipt of supporting information by the Company;

continued vesting of all stock option awards for 12 months following his termination date; and

continued participation in the health and welfare benefit plans of the Company for Mr. Raphaelson and his spouse and dependents, if any, for 12 months.

Mr. Raphaelson’s 2016 Employment Agreement (which was effective as of November 1, 2015) provides that, in the event that his employment is terminated by the Company for cause (as defined in his 2016 Employment Agreement and below), then Mr. Raphaelson would be entitled to receive:

his base salary through the date of termination of employment; and

| • | | the “Raphaelson 2016 Standard Benefits” consisting of:

|

reimbursement for expenses incurred but not paid prior to such termination of employment, subject to the receipt of supporting information by the Company; and

such other compensation and benefits as may be required by applicable law.

Mr. Raphaelson’s 2016 Employment Agreement provides that, in the event that the Company terminates his employment without cause (and other than due to his death or disability, a change in control or a notice

termination) or he terminates his employment for good reason (each term as defined in Mr. Raphaelson’s 2016 Employment Agreement and below), Mr. Raphaelson would be entitled to receive, in addition to the Raphaelson 2016 Standard Benefits:

continuation of his base salary for a 12-month period following the termination of his employment;

relocation to the city of his choice in the continental United States, subject to the Company’s relocation policy; and

continued participation in the health plans of the Company for one year following the date of his termination, provided that the Company’s obligation to provide these benefits shall cease under certain circumstances.

Under Mr. Raphaelson’s 2016 Employment Agreement, he is permitted to terminate his employment with the Company on the 12-month anniversary of a change in control (as defined in his 2016 Employment Agreement and the description of Mr. Adelson’s employment agreement above) upon at least 90 days’ notice. Under those circumstances, he would be entitled to receive, in addition to the Raphaelson 2016 Standard Benefits:

his base salary through the date of termination of employment and any previously earned but unpaid bonus for the prior year;

a lump sum payment representing one year of base salary; and

relocation to the city of his choice in the continental United States, subject to the Company’s relocation policy.

Under his 2016 Employment Agreement, in the event that Mr. Raphaelson’s employment with the Company is terminated due to his death or disability (as defined in his 2016 Employment Agreement and below), then Mr. Raphaelson or his estate, as the case may be, would be entitled to receive:

his base salary through the date of termination of employment; and

the Raphaelson 2016 Standard Benefits.

In the event that Mr. Raphaelson’s employment with the Company is terminated because of a notice termination (as defined in his 2016 Employment Agreement and below) by the Company on or before November 1, 2016, then Mr. Raphaelson would be entitled to receive, in addition to the Raphaelson 2016 Standard Benefits:

continuation of his base salary for six months, beginning January 1, 2017;

relocation to the city of his choice in the continental United States, subject to the Company’s relocation policy;

continued participation in the Company’s health plans until January 1, 2018, provided that the Company’s obligation to provide these benefits shall cease under certain circumstances;

a bonus for 2016 when and if such bonuses are paid to other executives, pro-rated if the effective date of notice termination is prior to December 31, 2016; and

pro-rated vesting of the stock options granted under the 2016 Employment Agreement that are scheduled to vest in the year of notice termination.

In addition, the Company may, in its discretion, postpone the payment of the six months of base salary and the provision of health plan benefits for up to four months to provide for a transition period. During this transition period, Mr. Raphaelson will receive his base salary and participate in Company benefit programs, but will not receive additional pro-ration of his bonus or option vesting.

In the event that Mr. Raphaelson’s employment with the Company is terminated because of a notice termination by the Company in a subsequent year (after November 1, 2016), then Mr. Raphaelson would be entitled to receive, in addition to the Raphaelson 2016 Standard Benefits:

continuation of his base salary for six months, beginning January 1 immediately following the effective date of notice termination;

relocation to the city of his choice in the continental United States, subject to the Company’s relocation policy;

continued participation in the Company’s health plans for one year following the effective date of notice termination, provided that the Company’s obligation to provide these benefits shall cease under certain circumstances;

a bonus for the year of notice termination when and if such bonuses are paid to other executives; and

vesting of the stock options granted under the 2016 Employment Agreement that are scheduled to vest in the year of notice termination.

In addition, the Company may, in its discretion, postpone the payment of the six months of base salary and the provision of health plan benefits for up to four months to provide for a transition period. During this transition period, Mr. Raphaelson will receive his base salary and participate in Company benefit programs, but will not receive additional pro-ration of his bonus or option vesting.

Definitions.The terms “cause,” “disability” and “good reason” were defined in Mr. Raphaelson’s 2011 Employment Agreement as follows:

Mr. Raphaelson may be terminated by the Company for “cause” if:

he is convicted of a felony or misappropriates any material funds or material property of the Company or its parent, subsidiaries or affiliated companies;

he commits fraud or embezzlement with respect to the Company or its parent, subsidiaries or affiliates;

he commits any material act of dishonesty relating to his employment by the Company resulting in direct or indirect personal gain or enrichment at the expense of the Company or its parent, subsidiaries or affiliated companies;

he uses alcohol or drugs that render him materially unable to perform the functions of his job or to carry out his duties to the Company and he fails to correct the situation following written notice;

he commits a material breach of his 2011 Employment Agreement and he fails to correct the situation following written notice;

he commits any act or acts of serious and willful misconduct (including disclosure of confidential information) that is likely to cause a material adverse effect on the business of the Company or its parent, subsidiaries or affiliated companies; or

his gaming license is withdrawn with prejudice, denied, revoked or suspended by the Nevada gaming authorities and he fails to correct the situation following written notice.

The term “disability” is defined in Mr. Raphaelson’s 2011 Employment Agreement to mean that Mr. Raphaelson shall, in the opinion of an independent physician selected by agreement between the Company and Mr. Raphaelson, become so physically or mentally incapacitated that he is unable to perform the duties of his employment for an aggregate of 180 days in any 365-day consecutive period or for a continuous period of six consecutive months.

The term “good reason” is defined in Mr. Raphaelson’s 2011 Employment Agreement to mean the occurrence of any of the following:

| • | | | | | DEFINITION | | DESCRIPTION IN MR. GOLDSTEIN’S EMPLOYMENT AGREEMENT | | | | Cause | | (i)• he is convicted of a felony

• he commits fraud or embezzlement with respect to the Company, its subsidiaries or affiliates • he commits any material act of dishonesty relating to his employment by the Company resulting in direct or indirect personal gain or enrichment at the expense of the Company, its subsidiaries or affiliates • he uses alcohol or drugs that render him materially unable to perform the functions of his job or to carry out his duties to the Company and he fails to correct the situation following written notice • he commits a material breach of his employment agreement and he fails to correct the 2011 Employment Agreementsituation following written notice • he commits any act or acts of serious and willful misconduct that is likely to cause a material adverse effect on the business of the Company, its subsidiaries or affiliates • his gaming license is withdrawn with prejudice, denied, revoked or suspended by any of the gaming authorities with jurisdiction over the Company or its affiliates and he fails to correct the situation following written notice | | | | Good Reason | | • the Company’s removal of Mr. Goldstein from the position of Chief Executive Officer of the Company • any other material adverse change in Mr. Goldstein’s status, position, duties or responsibilities (which shall include any adverse change in his reporting relationships) or location of principal office • Company’s material breach of its obligations under his employment agreement or any plan documents or agreements of the Company No purported termination for Good Reason will be effective unless the Company fails to cure the facts or events creating “Good Reason” within 30 days after written notice is delivered by Mr. Goldstein to the Company. | | | | Change in Control | | • Refer to “Change in Control Arrangements” as previously described for details | | | | Disability | | • Mr. Goldstein shall, in the opinion of an independent physician selected by agreement between the Board of Directors and Mr. Goldstein, become so physically or mentally incapacitated that he is unable to perform the duties of his employment for an aggregate of 180 days in any 365-day consecutive period or for a continuous period of six consecutive months |

| | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 53 |

Mr. Dumont The Company is obligated to pay or provide Mr. Dumont (or his estate) the following under the various termination scenarios pursuant to his employment agreement: | | | | | | REASON FOR TERMINATION | | MR. DUMONT IS ENTITLED TO: | | | Company Terminates for Cause | | “Dumont Accrued Benefits” consisting of: • base salary through the date of termination of employment • all previously earned bonuses through the date of termination of employment • reimbursement for expenses incurred, but not paid, prior to such termination of employment, subject to the receipt of supporting information by the Company; (ii)Company • such other compensation and benefits as may be provided in outstanding equity awards or applicable plans and programs of the Company, according to the terms and conditions of such awards, plans and programs | | | Company Terminates Without Cause or Executive Officer Terminates for Good Reason | | • Dumont Accrued Benefits • a reductionpayment of his base salary plus his target bonus, paid over 12 months post termination of employment • any unpaid bonus for the calendar year preceding the date of termination of employment • pro-rata target bonus for the year of termination • accelerated vesting of equity, except for the one-time performance-based stock options, which, in Mr. Raphaelson’s base salary; or (iii) a material changeaccordance with the applicable award agreement, will remain outstanding and will continue to vest as set out in the duties and responsibilitiesapplicable award agreement | | | Company Terminates Without Cause or Executive Officer Terminates for Good Reason within 24 months following a Change in Control | | • Dumont Accrued Benefits • accelerated vesting of office that would cause Mr. Raphaelson’s positionequity, except for the one-time performance-based stock options, which, in accordance with the applicable award agreement, will continue to have less dignity, importance or scope than intended atvest as set out in the effectiveapplicable award agreement • a lump sum payment in the amount of two times the sum of his base salary plus target bonus • any unpaid bonus for the calendar year preceding the date of termination of employment • pro-rata target bonus for the agreement;provided,however, that “good reason” shall not be deemed to occur solely as a resultyear of a transactiontermination • continued participation in whichthe health and welfare benefit plans of the Company becomes a subsidiaryand employer contributions to non-qualified retirement plans and deferred compensation plans, if any, for two years following the date of another company, so long astermination | | | Death or Disability | | • Dumont Accrued Benefits • continuation of base salary for 12 months following termination of employment, less any Company-provided short-term disability or life insurance proceeds • any unpaid bonus for the Mr. Raphaelson’s duties and responsibilitiescalendar year preceding the date of office are not materially changed as they relate solelytermination of employment • accelerated vesting of equity, except for the one-time performance-based stock options, which, in accordance with the applicable award agreement, will expire to the Company;extent unvested on the date of termination of employment due to death or disability |

| | | | | | | | 54 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

EXECUTIVE COMPENSATION AND OTHER INFORMATION Mr. Raphaelson discovers or the Company announces a “change of control,” which, for purposes of his 2011 Employment Agreement, is defined as Sheldon G. Adelson and the estate planning trusts of Sheldon G. Adelson currently identified in the most recent filing with the Securities and Exchange Commission (including any amendments, revisions, conversions, substitutions or otherwise of such trusts) control less than 50% of the voting equity of the Company; provided that a “change of control” ceases to constitute good reason unless Mr. Raphaelson gives notice to the Company that he is terminating his employment with the Company due to the “change of control” within 30 days after the first filing is made with the Securities and Exchange Commission by which the fact of such “change of control” could be determined.

The terms “cause,” “disability,” “good reason” and “notice termination”reasons for termination are defined in Mr. Raphaelson’s 2016 Employment AgreementDumont’s employment agreement as follows: Mr. Raphaelson may be terminated by the Company for “cause” if:

| | | | | | DEFINITION | | DESCRIPTION IN MR. DUMONT’S EMPLOYMENT AGREEMENT | | | Cause | | • he commits a felony or misappropriates any material funds or material property of the Company or any of its affiliates • he commits fraud or embezzlement with respect to the Company or any of its affiliates • he commits any material act of dishonesty resulting in direct or indirect personal gain or enrichment • he uses alcohol or drugs that render him unable to perform fully the functions of his job or to carry out fully his duties to the Company and he fails to correct the situation following written notice • he commits a material breach of his employment agreement as determined by the Company in its sole discretion and he fails to correct the situation following written notice • he commits any act or acts of serious and willful misconduct (including disclosure of confidential information) that is likely to cause a material adverse effect on the business of the Company or any of its affiliates and he fails to correct the situation following written notice • his gaming license is withdrawn with prejudice, denied, revoked or suspended by any of the gaming authorities with jurisdiction over the Company or its affiliates | | | Good Reason | | • the Company’s removal of Mr. Dumont from the position of President and Chief Operating Officer of the Company • a material adverse change in Mr. Dumont’s status, position, duties or responsibilities (which shall include his ceasing to be the President and Chief Operating Officer of a publicly-traded company or any adverse change in the reporting relationship), • Company’s material breach of its obligations under his employment agreement or any plan documents or agreements of the Company No purported termination for Good Reason will be effective unless the Company fails to cure the facts or events creating “Good Reason” within 30 days after written notice is delivered by Mr. Dumont to the Company. | | | Change in Control | | • Refer to “Change in Control Arrangements” as previously described for details | | | Disability | | • Mr. Dumont shall, in the opinion of an independent physician selected by agreement between the Board of Directors and Mr. Dumont, become so physically or mentally incapacitated that he is unable to perform the duties of his employment for an aggregate of 180 days in any 365-day consecutive period or for a continuous period of six consecutive months |

| | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 55 |

he commits a felony or misappropriates any material funds or material property of the Company, its subsidiaries or affiliates;

he commits fraud or embezzlement with respect to the Company, its subsidiaries or affiliates;

he commits any material act of dishonesty relating to his employment by the Company resulting in direct or indirect personal gain or enrichment;

he uses alcohol or drugs that render him unable to perform the functions of his job or to carry out fully his duties to the Company and he fails to correct the situation following written notice;

he commits a breach of his 2016 Employment Agreement, other than a de minimis breach as determined by the Chief Executive Officer in his sole discretion, and Mr. Raphaelson fails to correct the situation following written notice;

he commits any act or acts of serious and willful misconduct (including disclosure of confidential information) that is likely to cause a material adverse effect on the business of the Company, its subsidiaries or affiliates; or

his gaming license is withdrawn with prejudice, denied, revoked or suspended by any of the gaming authorities with jurisdiction over the Company or its affiliates and he fails to correct the situation following written notice.

The term “disability” is defined in Mr. Raphaelson’s 2016 Employment Agreement to mean that Mr. Raphaelson shall, in the opinion of an independent physician selected by the Company, become so physically or mentally incapacitated that he is unable to perform the duties of his employment.Hyzak

The term “good reason”Company is defined inobligated to pay or provide Mr. Raphaelson’s 2016 Employment Agreement to mean the occurrence of any ofHyzak (or his estate) the following without Mr. Raphaelson’s consent: his removal fromunder the position of the Company’s Executive Vice President and Global General Counsel; or

any other material adverse change in his status, position, duties or responsibilities (which shall include his not reporting to the Chief Executive Officer or the Chief Executive Officer’s designee) which is not cured within thirty (30) days after written notice thereof is delivered to the Company, such notice to be delivered to the Company within 90 days following Mr. Raphaelson first obtaining actual knowledge that facts or circumstances constituting good reason exist, and he actually terminates his employment within five days after the end of the cure period described above.

Mr. Raphaelson’s 2016 Employment Agreement and his employment thereunder will terminate on the effective date of “notice termination” with respect to 2016, or on December 31, 2017 or December 31, 2018, if either party has provided written notice to the other on or before the immediately preceding November 1 of such termination.

Mr. Markantonis

Mr. Markantonis’s employment agreement provides that in the event that his employment is terminated by the Company for cause (as defined in his employment agreement and below) or Mr. Markantonis terminates his employment agreement without good reason (as defined in his employment agreement and below), then Mr. Markantonis would be entitled to receive the “Markantonis Standard Benefits” described below:

his base salary through the date ofvarious termination of employment;

reimbursement for expenses incurred, but not paid prior to such termination of employment, subject to the receipt of supporting information by the Company; and

such other compensation and benefits as may be provided in applicable plans and programs of the Company, according to the terms and conditions of such plans and programs.

In the event that Mr. Markantonis’s employment is terminated by the Company without cause or he terminates his employment agreement for good reason, then,scenarios pursuant to his employment agreement, Mr. Markantonis would be entitled to receive, in addition to the Markantonis Standard Benefits:agreement:

continuation of his base salary for 12 months following termination of employment if his employment was terminated before March 1, 2016, or six months base salary if his employment was terminated thereafter;

| | | | | | REASON FOR TERMINATION | | MR. HYZAK IS ENTITLED TO: | | | Company Terminates for Cause | | “Hyzak Accrued Benefits” consisting of: • a base salary through the date of termination of employment • all previously earned bonuses through the date of termination of employment • reimbursement for expenses incurred, but not paid, prior to such termination of employment, subject to the receipt of supporting information by the Company • such other compensation and benefits as may be provided in outstanding equity awards or applicable plans and programs of the Company, according to the terms and conditions of such awards, plans and programs | | | Company Terminates Without Cause or Executive Officer Terminates for Good Reason | | • Hyzak Accrued Benefits • a payment of his base salary, paid over 12 months post termination of employment • any unpaid bonus for the calendar year preceding the date of termination of employment • pro-rata target bonus for the year of termination • accelerated vesting of equity, except for the one-time performance-based stock options, which, in accordance with the applicable award agreement, will remain outstanding and will continue to vest as set out in the applicable award agreement | | | Company Terminates Without Cause or Executive Officer Terminates for Good Reason within 24 months following a Change in Control | | • Hyzak Accrued Benefits • accelerated vesting of equity, except for the one-time performance-based stock options, which, in accordance with the applicable award agreement, will continue to vest as set out in the applicable award agreement • a lump sum payment in the amount of one times the sum of his base salary plus target bonus • any unpaid bonus for the calendar year preceding the date of termination of employment • pro-rata target bonus for the year of termination • continued participation in the health and welfare benefit plans of the Company and employer contributions to non-qualified retirement plans and deferred compensation plans, if any, for two years following the date of termination | | | Death or Disability | | • Hyzak Accrued Benefits • continuation of base salary for 12 months following termination of employment, less any Company-provided short-term disability or life insurance proceeds • any unpaid bonus for the calendar year preceding the date of termination of employment • accelerated vesting of equity, except for the one-time performance-based stock options, which, in accordance with the applicable award agreement, will expire to the extent unvested on the date of termination of employment due to death or disability |

| | | | | | | | 56 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

continued participation in the Company’s health and welfare benefit plans for Mr. Markantonis and his spouse and dependents, if any, for the 12- or six-month periods described above, as applicable;

any bonus for the year prior to termination but not yet paid in the year of termination, to be paid at the time such bonuses are awarded in the ordinary course; and

a pro-rated bonus for the year of termination, to be paid at the time such bonuses are awarded in the ordinary course.

In the event that Mr. Markantonis’s employment is terminated upon the expiration of the term of his employment agreement, then Mr. Markantonis would be entitled to receive, in addition to the Markantonis Standard Benefits:EXECUTIVE COMPENSATION AND OTHER INFORMATION

any bonus awarded